accumulated earnings tax c corporation

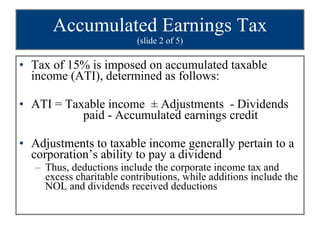

The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed. A personal service corporation PSC may accumulate earnings up.

S Corp Rias Disadvantaged By The Tax Bill Mercer Capital

The Tax Man Corp.

. For C corporations the current accumulated retained earnings threshold that triggers this tax is 250000. Its purpose is to prevent the accumulation of earnings if the reason for such is for shareholders to. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the.

The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends. Accumulated earnings and profits are a companys net profits. Accumulated Earnings Tax is a corporate-level tax assessed by the IRS.

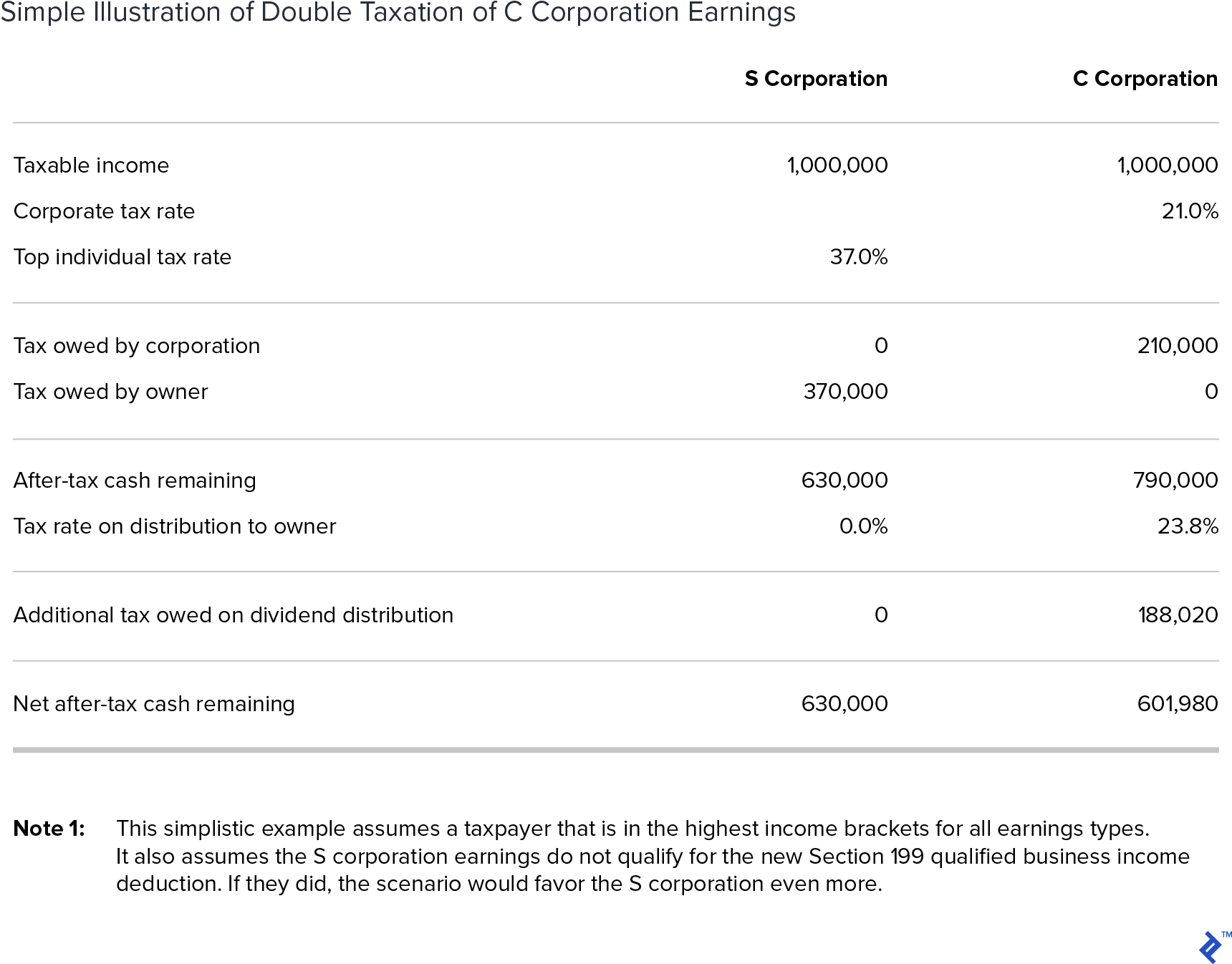

A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. Converting your S corporation to an LLC takes careful planning and a detailed knowledge of both business entity law and the Tax Code. Tax problems can be costly and confusing.

The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation. C corporations may accumulate earnings up to 250000 without incurring an accumulated earnings tax. However if a corporation allows earnings to accumulate.

May 17th 2021. At the end of the fiscal year closing entries are used to shift the entire balance in every temporary account into retained earnings which is a permanent account. The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue.

Taxpayers Assistance Center Inc. Accumulated earnings and profits E P is an accounting term applicable to stockholders of corporations. To trigger the tax you need to suffer an IRS audit that notes your failure to pay dividends when the corporations accumulated earnings exceed 250000 or 150000 for a.

The tax is assessed at the highest individual tax rate. Our system imposes a 20 percent tax on accumulated taxable income of a corporation availed of to avoid tax to shareholders by permitting earnings and. Filed as a Domestic Business Corporation in the State of New York on Friday January 3 1997 and is approximately twenty-five years old as recorded in.

Helps low income NJ and NY residents who have. This is because corporations that do not spend retained earnings. The tax is in addition to the regular corporate income tax and is.

Or call to schedule an. For advice and counsel that can reliably help you. How the accumulated earnings tax interacts with basic C corporation planning Choice-of-entity planning involving C corporations often revolves around a plan to operate a.

Appointment at 201 208-2200.

Ohio Income Tax Dividends From Accumulated C Corporation Earnings Retain Their Character And Are Non Taxable To Nonresident Shareholders Ohio State Tax Blog State And Local Tax Issues

Reg 2 Corporate Taxation Flashcards Quizlet

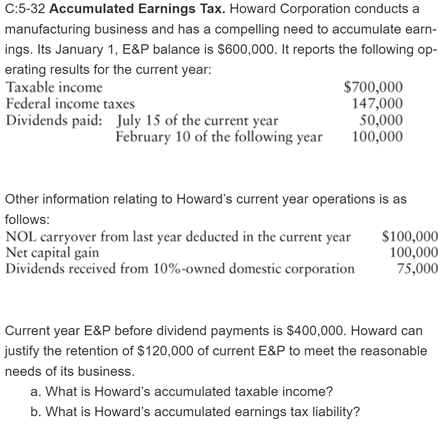

Solved C 5 32 Accumulated Earnings Tax Howard Corporation Chegg Com

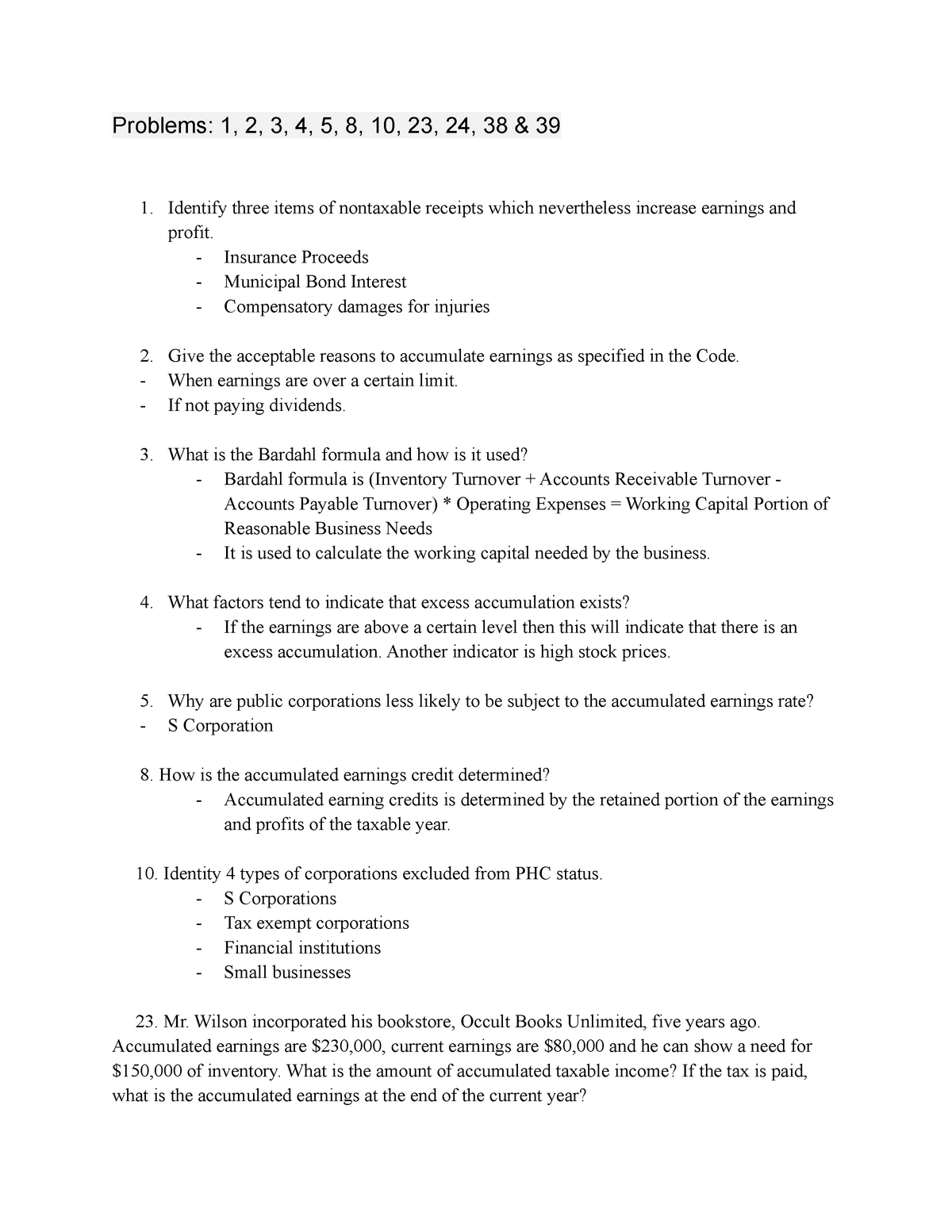

Module 18 Questions Homework Problems 1 2 3 4 5 8 10 23 24 38 Amp 39 Identify Three Studocu

How To Complete Form 1120s Schedule K 1 With Sample

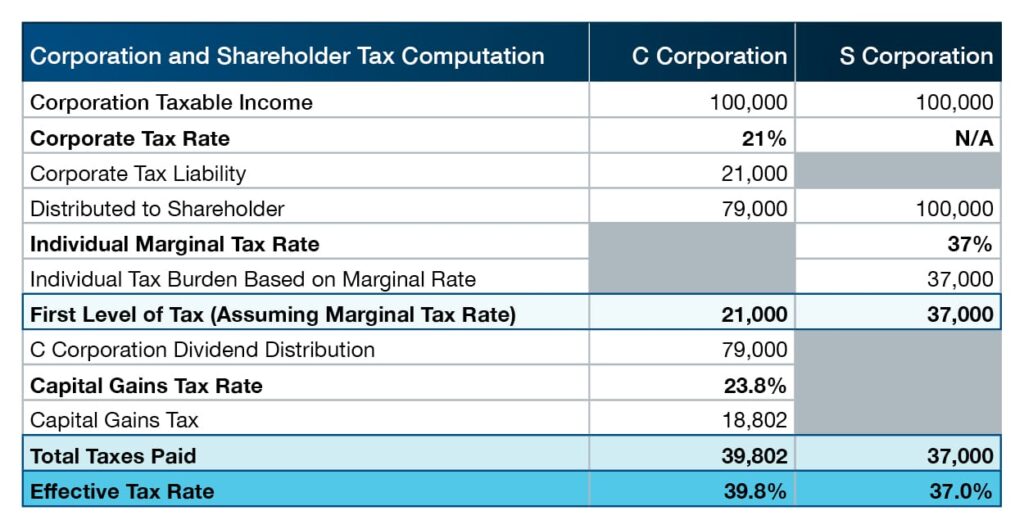

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act Smith And Howard Cpa

The Impact Of The Tax Cuts And Jobs Act S Repatriation Tax On Financial Statements The Cpa Journal

2022 Us Business Taxes Guide And Planning Ideas Let S Save Tax 西雅圖的節稅戰士

Darkside Of C Corporation Manay Cpa Tax And Accounting

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

Earnings And Profits Computation Case Study

Irs Expands On Reporting Expenses Used To Obtain Ppp Loan Forgiveness On Form 1120s Schedule M 2 Current Federal Tax Developments

Demystifying Irc Section 965 Math The Cpa Journal

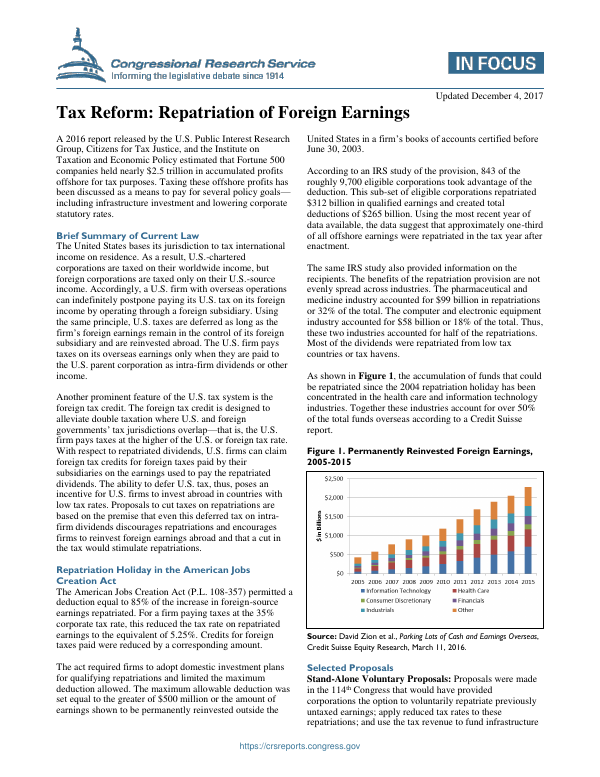

Tax Reform Repatriation Of Foreign Earnings Everycrsreport Com

Darkside Of C Corporation Manay Cpa Tax And Accounting

Is Corporate Income Double Taxed Tax Policy Center

S Corporation Or C Corporation Under The Tax Cuts And Jobs Act Pya